This article discussed a variety of topics related to general journals. You learned what general journals are, how to complete an entry, what they’re used for and more. Hopefully this article clears up any questions you have regarding general journals.

- Several bookkeepers choose to enter the specific day with the description of each entry.

- This is already automatically done in the background by the system as you enter the details of a transaction in the fields provided by the software.

- All transactions are assumed and simplified for illustration purposes.

- We’ve gone through 15 journal entry examples and explained how each are prepared to help you learn the art of recording.

What is the approximate value of your cash savings and other investments?

In accounting, a general journal is a record where all business transactions are initially recorded, using the double-entry accounting method, before they are posted to the ledger accounts. The general journal is often called the book of original entry, as it’s the first place the transactions are recorded. An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event. After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal.

Common Journal Entry Questions

The journal allows the recording of transactions in one place, unlike in a ledger where a single transaction will be recorded separately in different ledger accounts. This results to an easier lookup and analysis of transactions that occurred during a period. An Accounting Journal is a record containing a chronological listing of business transactions. It is also called the Book of Original Entry since this is where a transaction is initially recorded before being posted to the ledger.

To Ensure One Vote Per Person, Please Include the Following Info

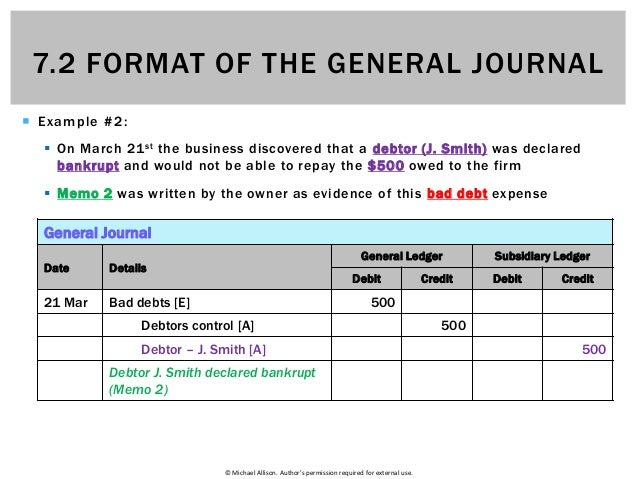

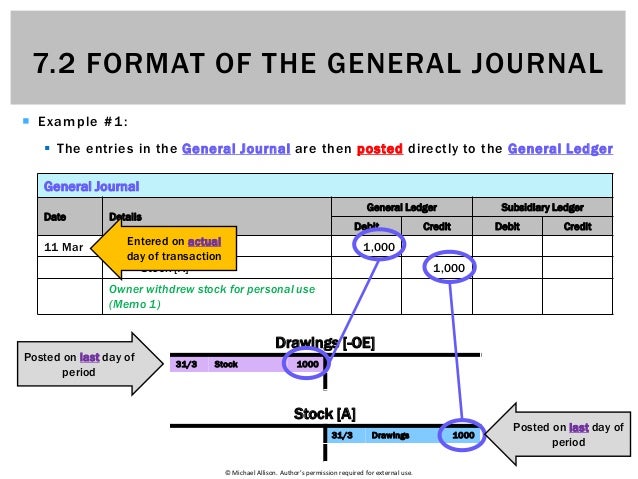

The general journal is the repository for transactions that are not recorded in a specialty journal. Thus, the general journal can be considered an intermediate repository of information for some types of information, on the way to its final recordation in the general ledger. Once the journal entries are posted to the ledgers, the posting reference column can be filled out with the ledger number or abbreviation that the entry was posted to. The ledgers can then be used to make a trial balance and eventually a set of financial statements. Obviously, if you don’t know a transaction occurred, you can’t record one. Using our vehicle example above, you must identify what transaction took place.

These include helping to track sales, purchases, inventory, expenses and more. A general journal is just one of the several types of books that can be used to store information. They can be used to show balance sheets and cash flow statements.

Are General Journals the Same as General Ledgers?

They can also be used in the event of litigation or bankruptcy proceedings to provide evidence. Each of these journals has a special purpose and are used to record specific types of transactions. For example, the cash receipts journal contains all of the cash sale transactions. The accounts receivable or credit sales journal contains all the transactions for credit sales. The general journal, also called the book of first entry, is a record of business transactions and events for a specific account. In other words, this journal chronologically stores all the journal entries for a specific account or group of account in one place, so management and bookkeepers can analyze the data.

The increase in sales should be recorded on the credit side of the sales ledger. The entity also records other non-financial transactions that occur in the business into this book also. That non-financial transaction included depreciation, adjustments as well as 5 payment reminder templates to ask for overdue payments an accrual. Those financial transactions including sales transactions, purchase transactions, cash receipts, cash payments, and many other important financial transactions. I know how difficult it can be to memorize how each business transaction is recorded.

If the bank pays it, then we should credit the same amount by banks. After making entries in the general journal format in accounting, all the transactions are summarized and posted in the ledger. The debit part of the entry is first written and the credit part of the entry is written below the debit part. It is usually expected that you leave some space at the left-hand margin before writing the credit part of the journal entry. In this column, a brief description known as narration is written below the credit part of the entry. The description column is used to enter the names of the accounts involved in the transaction.

The company can have more specialty journals depending on its needs and type of transactions, but the above four journals contain the bulk of accounting activities. In the accounting cycle, the first step is transaction analysis which provides the information needed to journalize a transaction. When a transaction is recorded in the books of accounts, it is referred to as making an entry. Therefore, recording a transaction in the journal is known as a journal entry.