Next, we look at how a bank uses debit and credit when referring to a company’s checking account transactions. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. Similarly, if a businessman deposits any checks on the last day of the month, these cheques may be collected by his bank and shown on his bank statement three or four days later. Similarly, some checks credited to the ledger account will probably not have been processed by the bank prior to the bank statement date.

Bank Reconciliation: Purpose, Example, and Process

This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement.

To detect bank errors

However, you typically only have a limited period, such as 30 days from the statement date, to catch and request correction of errors. (b) Checks Nos. 789 and 791 for $5,890 and $920, respectively, do not appear on the bank statement, meaning these had not been presented for payment to the bank by 31 May. They also explain any delay in the collection of cheques, and they identify valid transactions recorded by one party but not the other. Banks often record other decreases or increases to accounts and notify the depositor by mailed notices. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. She has more than five years of experience working with non-profit organizations in a finance capacity.

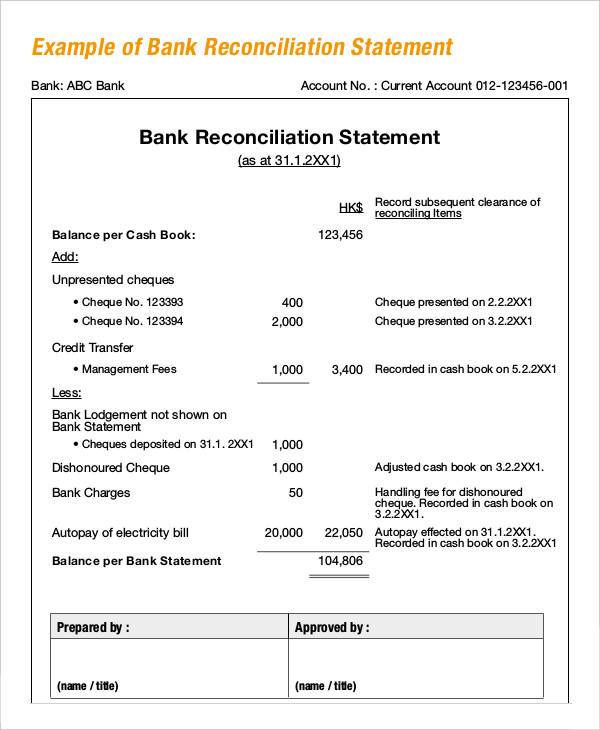

Bank Reconciliation Statement

If a company is unaware of the exact amount of these fees, they may not be included in the company’s financial records and will only be seen when they receive their bank statement. Once you have identified all the differences between the two statements, identify the source of the discrepancy. Common sources include deposits in transit that have not yet been deposited in your bank account, as well as bank fees that have been withdrawn by your bank but may have been missed in your company records. A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank. A bank reconciliation is used to detect any errors, catch discrepancies between the two, and provide an accurate picture of the company’s cash position that accounts for funds in transit. Taking the time to perform a bank reconciliation can help you manage your finances and keep accurate records.

- Or there may be a delay when transferring money from one account to another.

- The balance recorded in your books (again, the cash account) and the balance in your bank account will rarely ever be exactly the same, even if you keep meticulous books.

- When all these adjustments have been made to the books of accounts, the balance as per the cash book must match that of the passbook.

- This way, the number of items that can cause the difference between the passbook and the cash book balance is reduced.

- These deposited checks or discounted bills of exchange drawn by your business may get dishonored on the date of maturity.

- However, with today’s online banking a company can prepare a bank reconciliation throughout the month (as well as at the end of the month).

One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts. These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month.

As such, exact amounts may not be accurately included on financial statements before the reconciliation process. When the business receives its bank statement, it can use the final amounts of interest and investment income to make adjustments and reconcile its financial statements. By comparing the two statements, Greg sees that there are $11,500 in checks for four orders of lawnmowers purchased near the end of the month.

These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. The items therein should be compared to the new bank statement to check if these have since been cleared. Examples include deposited checks returned for non-sufficient funds (NSF) or notes collected on the depositor’s behalf. Once the balances are equal, businesses need to prepare journal entries to adjust the balance per books. After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same.

For example, if a check is altered, the payment made for that check will be larger than you anticipate. If you notice this while reconciling your bank accounts, you can take measures to halt the fraud and recover your money. When the bank debits a depositor’s checking account, the depositor’s checking account balance and the bank’s liability to the customer/depositor are decreased. A bank reconciliation statement is a document that is created by the bank and must be used to record all changes between your bank account and your accounting records.

Such information is not available to your business immediately, so you record no entry in the business’ cash book for the above items. You will know about this only when you receive the bank statement at the end of the month. As a result, your balance as per the passbook would be less than the balance as per the cash book. Likewise, ‘credit balance as per cash book’ is the same as ‘debit balance as per passbook’ means the withdrawals made by a company from a bank account exceed deposits made. An outstanding check refers to a check payment that has been recorded in the books of accounts of the issuing company, but has not yet been cleared by the bank as a deduction from the company’s cash balance. The balance recorded in the passbook or the bank statement must match the balance reflected in the customer’s cash book.

Accurate cash flow is essential for keeping a business running smoothly, so it’s important to be aware of all incoming and outgoing cash. A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow. xerocon us 2016 If your bank account, credit card statements, and your bookkeeping don’t match up, you could end up spending money you don’t really have—or holding on to the money you could be investing in your business. This can also help you catch any bank service fees or interest income making sure your company’s cash balance is accurate.