Content

- Defining Uncollectable Accounts

- Timing Issues – The Weaknesses of the Direct Write-Off Method

- Direct write off method definition

- The Direct Write-Off Method in Practice – Introduction to the Direct Write-Off Method for Beginners

- Direct Write-Off Method vs. Allowance Method

- Overview: What is the direct write-off method?

- Resource Cost Write-Off

If you’re wondering which method is best for your small business, speak with a professional for insights into your specific situation. Using the direct write-off method also violates the GAAP because of how it records things on the balance sheet. Financial statements are not giving an accurate portrayal of how the business is doing financially. Amounts over 12 months old lacking current productive activity are required to be written-off. How long is appropriate for a company to leave past due A/R on the books before writing it off? There are a few accounts that have been on the A/R Aging Report for over a year, some even over 2+ years. When I request that we write them off as bad debt, the president of the company keeps telling me he wants to leave them on there longer.

How to Use the Direct Write-Off Method in 2023 – The Motley Fool

How to Use the Direct Write-Off Method in 2023.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

Since a special journal’s column totals are posted to the general ledger at the end of each accounting period, the posting to J. Smith’s account is the only one shown with the cash receipts journal entry in the illustration below. Bad debt expense is a natural part of any business that extends credit to its customers. Because a small portion of customers will likely end up not being able to pay their bills, a portion of sales or accounts receivable must be ear-marked as bad debt. This small balance is most often estimated and accrued using an allowance account that reduces accounts receivable, though a direct write-off method may also be used. The direct write-off method expenses bad debt once a customer account is determined as uncollectible.

Defining Uncollectable Accounts

Once any part of the accounts receivable becomes bad debt, the company’s balance sheet can be considered overstated. This can become a major audit concern if the amount of uncollectable debt is too high. On the company’s financial statements, the debit to bad debt expense in the journal entry will reduce the company’s profit by the amount that income was recognized in a previous period. Because the customer’s account balance is “written-off” or decreased by a credit to accounts receivable, the company’s current assets shown on the balance sheet are also reduced by $12,500. Since the bad debt has a relationship to the revenue reported, ideally a company would want to match the bad debt to the same period in which the revenues were earned.

What are the differences between direct write-off method and allowance method which method is better suited to expense recognition principle why?

The key difference between direct write off method and allowance method is that while direct write off method records the accounting entry when bad debts materialize, allowance method sets aside an allowance for possible bad debts, which is a portion of credit sales made during the year.

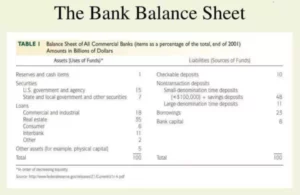

It is based on the Direct Write-Off Methoding equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. Under the direct write off method, when a small business determines an invoice is uncollectible they can debit the Bad Debts Expense account and credit Accounts Receivable immediately. This eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. The allowance method estimates bad debt expense at the end of the fiscal year, setting up a reserve account called allowance for doubtful accounts. Similar to its name, the allowance for doubtful accounts reports a prediction of receivables that are “doubtful” to be paid. This is why GAAP doesn’t allow the direct write-off method for financial reporting.

Timing Issues – The Weaknesses of the Direct Write-Off Method

At the end of the https://www.bookstime.com/ year, XYZ Ltd. found that two of its customers, Customer A and Customer B, had failed to pay their outstanding balances of $8,000 and $5,000, respectively. The Coca-Cola Company , like other U.S. publicly-held companies, files its financial statements in an annual filing called a Form 10-K with the Securities & Exchange Commission .