Contents

This account is credited for cash paid, or promised to be paid, by a shareholder for a share, however solely when the shareholder pays more than the price of a share. This account can be used to write off fairness-related expenses, corresponding to underwriting prices, and may also be used to issue bonus shares. The company doesn’t concern shares in trade for any items or providers so there shall be no profit or achieve by this. A balance is recorded in this account solely when there is a direct share sale from the corporate, often from a capital raise or preliminary public offering.

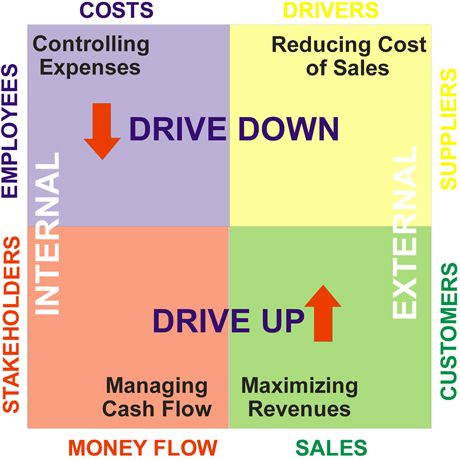

But that never occurs in practice, as there are different price levels for different individuals and companies—both when purchasing and selling. Sellers are actively competing with other suppliers to sell at the best value transfer as much inventory as possible. A surplus defines the sum of an asset or resource surplus capital is also known as over the portion that is actively used. It may refer to a host of different things, such as sales, income, resources, and products. It defines the items of inventories that remain unused, unbought, or on store shelves. Reserves help a business meet its liabilities, and you can use them to fund other projects.

Reserves are primarily created to protect the company’s financial position by providing funds for anticipated, planned, or unknown future costs. While surplus helps a business avoid unforeseen costs, it can also be misused if the funds are not allocated to a specific purpose. Reserves are important as they help you build up your business’s capital and pay dividends. They can help you keep up with the dividend distribution, while you can use the surplus to cover unforeseen expenses. Note the amount listed within the balance sheet against the line item’ Reserves & surplus’ with the note referred. Additionally, make sure the calculations or sums contained within the notes are correct, and verify that the note reference on the balance sheet is accurate.

What is the purpose of share premium?

The extra amount is charged over an amount equal to every value’s share when shares are exchanged, given or taken away. Is quite excited https://1investing.in/ in particular about touring Durham Castle and Cathedral. Here are the top four types of capital organizations focus on in more depth.

The share premium account represents the distinction between thepar valueof the shares issued and the subscription or concern price. When the shareholder of a BV is a international party, the notary will require a legalised resolution. After the execution of the shares the notary will care for the registration of the increase of share capital at the Dutch commerce register. After the execution of the deed, the newly issued shares could be paid up by the shareholder by the use of a transfer to the company. The capital could be paid again to the shareholders and must be repaid at par worth. You can not repay share capital at a premium or repay at lower than the nominal value.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

What is share premium example?

ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. A surplus happens when there is some sort of disconnection between supply and demand for a commodity, or when certain people are willing to pay more than others for a commodity. If there were a fixed price for a specific popular product that all were uniformly required and able to pay, there would be no surplus or shortage.

The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. Depending on the type of reserve, you can use it to strengthen its position in the market, pay dividends to shareholders or increase working capital. Just upload your form 16, claim your deductions and get your acknowledgment number online.

Secondary buying and selling, between buyers, doesn’t impression the share premium account. Share premium could be money obtained for the sale of either frequent or preferred stock. In general, money is essential for the day-to-day operations of a business. The finance professionals in an organization keep a tab on the capital requirements.

Thus, the companies should ensure some surplus short term funds to face emergencies. Capital is a broad term for anything that gives its owner value or advantage, like a factory and its equipment, intellectual property like patents, or a company’s or person’s financial assets. Even though money itself can be called capital, the word is usually used to describe money used to make things or invest.

- The share premium could be money received for the sale of either frequent or most well-liked stock.

- Just upload your form 16, claim your deductions and get your acknowledgment number online.

- The capital is mostly of three types, equity capital, debt capital and working capital.

- A balance is recorded in this account solely when there is a direct share sale from the corporate, often from a capital raise or preliminary public offering.

Premium or discount on a share simply means at what price share is being sold/traded. Adani speaks for first time since turmoil as stock rout continuesAdani said the decision to withdraw the FPO will not have any impact on the group’s existing operations and future plans. “We will continue to focus on timely execution and delivery of projects.” Understanding the difference between the two is vital, as is the same audit process. Also, you can automate online payment transactions through platforms like Khatabook, and such automation can save a lot of your time. A reserve can also be used to pay off debts, pay bonuses and settle legal obligations.

Are the cumulative profits an organisation has earned and kept over time. Retained profits are the earnings that remain after repaying shareholders. General reserves are a result of profits and are set aside for the company’s financial strength during bad times. According to Companies Act 2006 s.610 within the United Kingdom the share premium account could also be put only to sure specified makes use of. The Companies Act 2006 permits a private company to utilise the share premium account and switch this reserve to the profit and loss reserve, which means it becomes distributable. In order to do that, the corporate must go through a capital discount process.

Know Everything About The Competition Commission of India (CCI)

Private equity comes from a small group of investors, while public equity comes from selling shares of a company on a stock exchange. Usually, the equity is the risk capital which is invested to generate higher returns than debt. Individuals see debt as a burden, but if used efficiently, it can enhance the return on equity, as long as the debt amount is manageable.

Share premium can normally be used for paying fairness related expenses such as underwriter’s fees. The costs and bills relating to issuance of latest shares may also be paid from the share premium. A firm can use the steadiness of the account just for purposes which have been established in its bylaws.

No premium is received by the company when shares are additional sold in the secondary market. The use of it’s restricted to the aim as specified in the company bylaws. It is part of the corporate’s retained earnings however cannot be handled as the free reserve.

Mutual fund Investments

A share premium account shows up in the shareholders’ equity portion of the steadiness sheet. The share premium account represents the distinction between the par value of the shares issued and the subscription or concern worth. It’s also known as extra paid-in capital and may be called paid-in capital in extra of par value.

This is a $4 low cost per share to par worth, and thus subtracts $four hundred from the share premium account, leaving it at $1,a hundred. However, in the later portion of the 2-12 months interval, the corporate experiences a surge in the market. The funds in the share premium account can’t be distributed as dividends and will only be used for functions outlined in the company’s bylaws or different governing paperwork. Often, the share premium can be used to pay the bills of issuing equity, corresponding to underwriter fees or for issuing bonus shares to shareholders.

Debenture Redemption Reserve

In a strict accounting sense, share capital is the nominal value of issued shares . In phrases of the shareholders’ equity, the primary account is often the widespread inventory account adopted by the additional paid-in capital account. Other accounts appearing within the shareholders’ fairness part of the stability sheet can embody accrued different comprehensive earnings, treasury inventory, and unearned compensation. Instead, it’s more commonly recorded in an account known as Paid-In Capital In Excess of Par Value.

The money made from its current activities is shown as capital on a company’s balance sheet. Some examples are the money in a bank account, the money from selling stock shares, and the money from selling bonds. The business can make line items to represent assets in the balance sheet if they believe it’s essential for proper accounting to be reported. However, they are helpful when a company assumes that its assets will change after a specific time. Shareholders pay $35 per share, including $6,000 to the share premium account, leaving the account’s stability at greater than $7,one hundred.

Small businesses with few resources can get cash from their relatives or online lenders. Small businesses might also approach online crowdfunding sources to get capital. The information, product and services provided on this website are provided on an “as is” and “as available” basis without any warranty or representation, express or implied. Khatabook Blogs are meant purely for educational discussion of financial products and services. Khatabook does not make a guarantee that the service will meet your requirements, or that it will be uninterrupted, timely and secure, and that errors, if any, will be corrected.